-

Future Regulatory Intervention and the Coronavirus Pandemic

Posted By Stephanie Jordan

In previous blogs we’ve discussed the current challenges facing financial institutions today and have provided some suggestions on how to address them, but what about challenges that are out of our control? Today, we want to discuss what we may see in the coming months particularly from regulators. While we cannot predict the future with certainty, we can leverage what history has taught us from government agencies and what actions they may take going forward.

Let’s take a look back at the 2008 financial crisis again. If regulators respond similarly to the current emerging financial crisis, they may decide to provide lifelines to larger banks while community banks and credit unions are left in a “sink or swim” scenario. The Troubled Asset Relief Program (TARP) was a major component of the recession and the 2008 financial crisis, and it may be necessary to implement a second round of TARP, with the hopes that TARP will be more inclusive of community banks and credit unions.

Back in 2008, blame was generally placed on the financial industry for causing some of the downturn issues that led to the financial crisis, and as a result congressional leaders in conjunction with regulatory authorities built a series of regulations that increase industry costs for compliance. These same bodies also determined that financial institutions needed to improve their capital structure so that a future financial crisis requires less government intervention.

Financial institutions play a vital role in driving the economy and maintaining stability over time, but no one predicted that a healthcare crisis could devastate the economy as rapidly as the Coronavirus pandemic has. If this crisis continues, the impacts on smaller financial institutions could be as severe as the 2008 financial crisis or even more devastating.

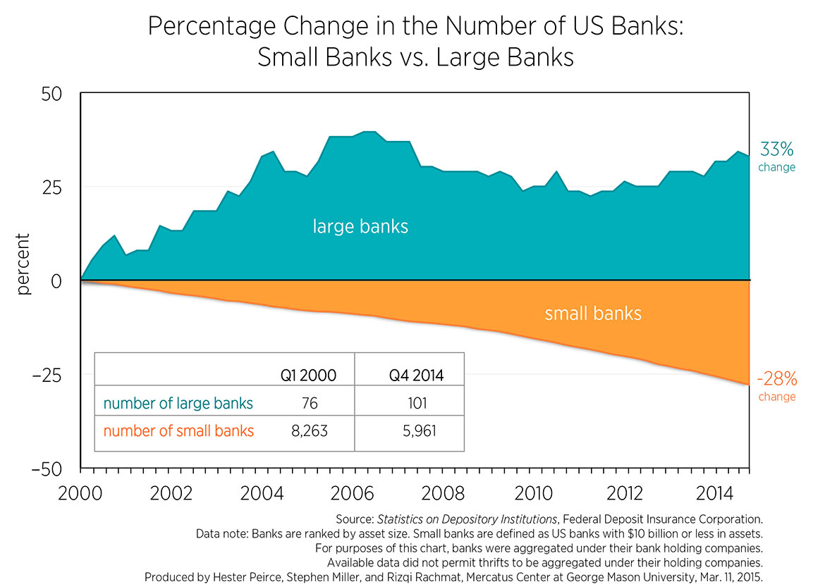

Stronger and more expensive regulatory compliance burdens have led to a larger decline in community banks through mergers and acquisitions at the expense of the larger banks. You can see in the graph below that from the first quarter of 2001 through the fourth quarter of 2014 the number of community banks declined 27 percent, while the number of larger banks increased by 33 percent. Will this pandemic lead to another reduction in the number and total assets of community banks and credit unions? It is important to ask ourselves what we can do if this trend continues.

If you would like to learn more about how to balance long-term profitability and capital while still helping your customers and members during this unprecedented time, please check out our latest on-demand webinar, “How to Deal with the Coronavirus Pandemic: A Huge Dilemma for Financial Institutions.” This webinar discusses the following topics:

- Similarities and differences from the 2008 banking crisis, and what we’ve learned from it

- The areas that financial institutions will be squeezed, and proactive measures that need to be taken now

- What we might expect from regulators down the road based on what we learned from the 2008 banking crisis

- Steps you need to be taking now to rebuild liquidity and pull out of this dilemma in the future