-

Real-Time Payments are Coming to America

Posted By John Mateker

In November of last year, The Clearinghouse (TCH) demonstrated the first Real-Time Payment, or RTP as their product is known within the U.S. While the payment was only for $3.50 and the accounts at the two counter party banks belonged to the same individual, the transaction took 3 seconds from origination at the sending bank to posting at the receiving bank. This milestone transaction paves the way for more experimentation in RTP transactions among a number of larger banks during 2018. The goal for RTP is to eventually make it available to any bank or credit union willing to participate in the program. Rolling this out across the entire financial services landscape in the US will take several years.

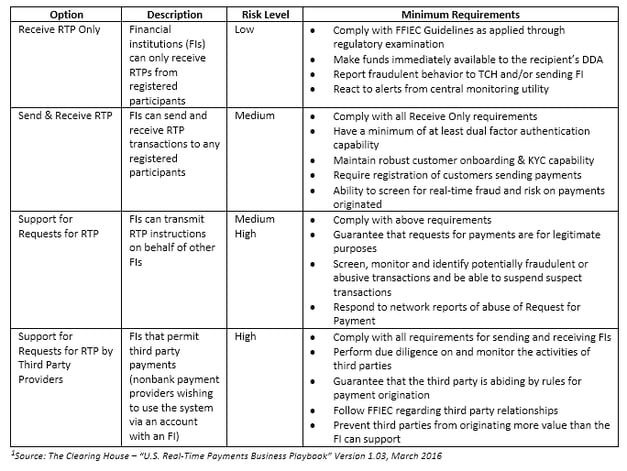

Several different participation options are available within the RTP environment for financial and third party providers such as FIS, Fiserv, Jack Henry, and others. These include Receive RTP, Send and Receive RTP, Support Requests for RTP, and Support for Requests for RTP by Third Party Providers. Across this order of different activity levels are also increased degrees of risk and therefor greater requirements controls. The following table shows each option and corresponding requirements.1

Non-bank third party service providers must apply to participate in RTP services and enter into an agreement with TCH to abide by all system requirements for third party providers. These providers must also certify to comply with certain risk management requirements, certain consumer protection laws and regulations as if the third party were an FI.

Real-Time Payments have 10 key characteristics that define them, which will help financial institutions develop new payment products and capabilities to enhance service offerings and potential fee income in the future. These characteristics included the following:

1. The RTP system will operate on a 24x7x365 model meaning that the system will be available anytime, night or day, or any holiday for payment transactions.

2. Recipients will receive payment immediately unless there is some risk or legal issue with the payment.

3. Payment certainty is guaranteed with the system once a payment has been authorized and no errors are associated with the transaction.

4. The RTP system is ubiquitous to all financial institutions. Any size or type of financial institution can obtain access to the system.

5. Rich and flexible messaging functionality is included in the system to provide value-added services.

6. To help ensure privacy and make it more difficult to create fraud, FIs will be able to use tokens in lieu of actual account numbers when transmitting payment information.

7. To further deter fraudulent activity, the system requires participants to provide strong authentication prior to initiating payments. The RTP system will also provide fraud monitoring and reporting tools.

8. With immediacy of payment transactions, customers will have greater cash flow control.

9. The RTP system has been built with a flexible architecture to adapt to changing market needs.

10. The system will adhere to global standards as much as possible.

With a system that operates in an anytime mode, banks and credit unions will need to adapt their systems and capabilities to operate within this type of model. Most financial institutions operate in a batch mode, which allows for payments and other transactions to post after the close of business. Some FIs will perform intraday transaction posting that is usually in the form of a debit hold or credit memo which identifies the money earmarked for some kind of transaction, but may not be reflected in the actual balances.

Community banks and credit unions may need to work with their technology partners to help them manage in an RTP environment. Operating in a real-time environment may open the door to even greater capabilities across the industry, and provide customers with a stronger customer experience, bringing the industry closer to how other digital services work.

For more information about RTP and its potential, FIs should refer to The Clearinghouse at www.theclearinghouse.org.