MARKET VIEW

Enhance Revenue Through Competitive Intelligence

Maximize Revenue with Smart Data & Competitive Analysis

$75,000 - $150,000

New Income Annually

per $100 Million Total Assets

How it Works

| A STRATEGY FOR PRODUCT PRICING & DESIGN

Blending the Power of Competitive Intelligence & Income Optimization

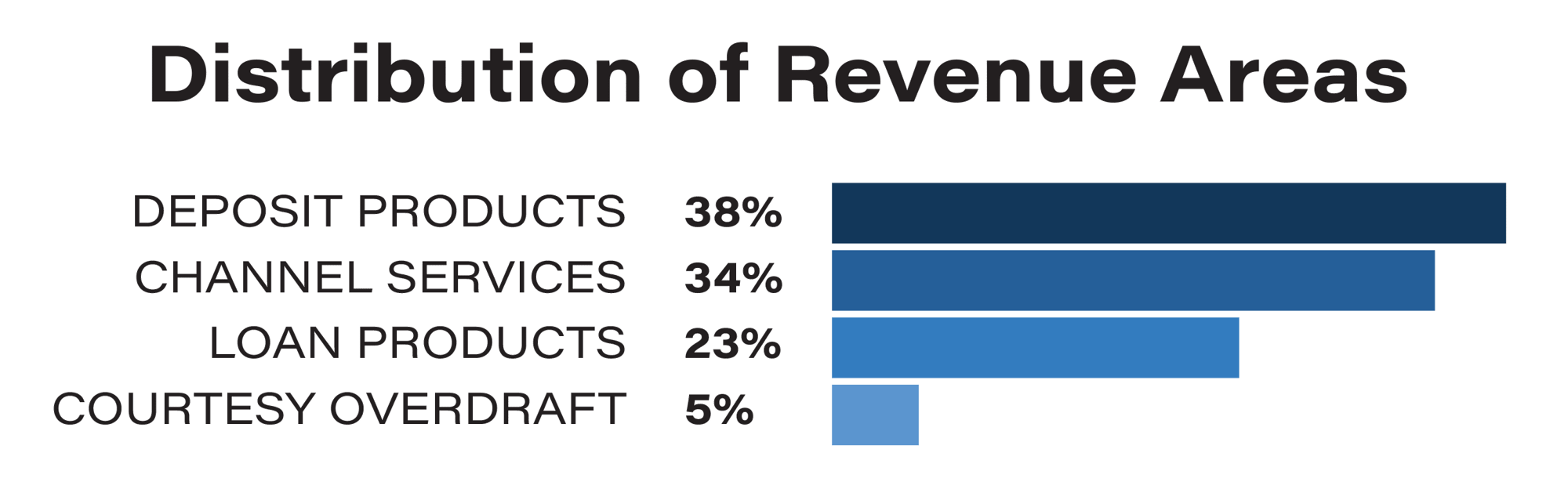

Market View is a competitive intelligence and income optimization solution that focuses on product strategy, pricing and design, with an analysis of more than 360 revenue areas across both sides of the balance sheet, including loan products, deposit products, and ancillary services.

| VALUE PROPOSITIONS

- ROI Guarantee

- Customized Engagement

- Actionable Intelligence

- Third-Party Consulting

- Holistic Assessment

- Resource Efficient

| OBJECTIVES

Competitive Intelligence

- Enhance Products & Services

- Improve Visibility of Competitors & Markets

- Improve Strategic Position in Key Markets

Income Optimization

- Increase Revenue [Non-Interest Income]

- Optimize Product Profitability

- Reduce Revenue Leakage

| PRODUCT & SERVICE ASSESSMENT

Competitive Intelligence

MARKET RESEARCH

Our Market Research & Insights team will examine your competitors for every line of business, including loans, deposits, and services, to assess the competitive landscape across each of your markets within your geographic footprint.

MYSTERY SHOPPING & SURVEYS

A series of mystery shopping and surveying initiatives designed to provide us with actionable data points that reflect the current state of your market.

RATE & FEE INFORMATION

See how your product fee structures and rates compare to your top competitors to uncover new opportunities to increase revenue.

PRODUCT PRICING & COMPARISONS

Product comparisons with your competitors are examined; including the performance, pricing, and characteristics of more than 360 different revenue areas.

COMPETITOR DATA & ANALYSIS

Establish measurable benchmarks that align with your financial institution's growth and profitability goals.

Income Optimization

PRODUCT PRICING & DESIGN

Identify opportunities to reposition your product pricing and design strategy to improve profitability and in-market adoption.

PRODUCT ALIGNMENT & OPTIMIZATION

Enhance your product's in-market appeal by ensuring that it aligns with the needs of your customers and members.

PRODUCT PROFITABILITY

Through rich analysis of your current product offerings, we'll work with you to increase your earnings and enhance product profitability.

PRODUCT REVENUE LEAKAGE

Determine and solve the sources of your most significant revenue leaks to increase top-line revenue while providing a positive customer and member experience.

| DATA-DRIVEN ANALYSIS & INSIGHTS

360+ Revenue Areas

Both Sides of the Balance Sheet

| DEPOSIT PRODUCTS

135+ areas across all deposit product categories:

Consumer Deposits

- Checking Accounts

- Savings Accounts

- Money Market Accounts

- CDs

- IRAs

- Checking Accounts

- Savings Accounts

- Money Market Accounts

- CDs

| ANCILLARY SERVICES

140+ areas across all ancillary service categories:

- Deposit Services Charges

- Courtesy Overdraft Program

- Electronic Banking

- ATMs

- Cash & Treasury Management

- Safe Deposit Boxes

- All Other Ancillary Services

| LOAN PRODUCTS

85+ areas across all 3 major loan product categories:

Commercial Loans

- Commercial Real Estate

- Commercial & Industrial

- Construction & Development

- Commercial LOC

Mortgage Loans

- 1st Mortgage

- Fixed and Variable

- Portfolio and Secondary

Consumer Loans

- Home Equity Loans

- HELOCs

- Auto/Motorcycle/Boat/RV

- CD/Savings/Stock Secured

- Unsecured Term Loans

- Overdraft/Unsecured LOC

- Credit Cards

- Payment Deferral Programs

| 3-PHASE APPROACH TO OPTIMIZING INCOME

Minimal Disruption. Maximum ROI.

We are committed to ensuring minimal disruption to your team, as we understand the importance of their daily work in driving some of the other key initiatives within your organization.

We perform 95% of the work on the engagement, with just two onsite visits comprising only 4 days.

We will carefully coordinate a schedule with your team that is flexible with the calendar of your organization, and work at a pace that meets your needs and strategic objectives.

Phase I: Assessment [60 Days]

- Data Collection & Stakeholder Interviews [3 Days Onsite]

- Perform Analysis & Identify Opportunities

- Report of Findings & Recommendations [1 Day Onsite]

Phase II: Implementation [60 Days]

- Develop Implementation Plan

- Assist in Execution

- Ensure Successful Implementation

Phase III: Monitoring [3 -6 Months]

- Develop Monitoring Reports

- Train Personnel on Monitoring Methodology

- Measure Benefits Monthly