-

Updates: Credit Union Mergers & Acquisitions

Posted By Matthew Speed

Review: M&A in 2017

Last year I wrote a post discussing credit union (CU) merger and acquisition (M&A) activity over the last several years and the drivers of this activity. I discovered that a great deal of CU M&A activity is attributed to the regulatory burdens on the overall industry, as well as the large number of CUs that are converting away from SEG based membership and to community charters.

In 2017 alone, another 21 CUs converted away from SEG based charters to Community Charters. Compare this to total new SEG charters in 2017, only 2 for the entire year! The overall industry appears to be shifting to community based charters. How this impacts M&A activity is uncertain. Until 2005, about 82% of Credit Unions were structured as SEG based memberships. Because of this structure, mergers between CUs were often driven by mergers between businesses. If large companies that both had established CUs merged, such as an airline, that would prompt a merger of their CUs.

The structure of CUs is very important when looking at M&A, because the majority of M&A activity now happens between smaller (less than $100mm in assets) community based CUs. Also interesting is some of the drivers of these mergers. The NCUA gives a lot of detail around CU mergers, including the reason behind the merger. The two most common reasons fall into two categories; the CUs are trying to expand and offer members new services, or one of the CUs is in poor financial condition and needs help. However, the third most common reason is that one of the CUs can’t find qualified officials to assist in running the institution. This highlights a significant difference between banks and CUs, the active role of a board of directors [CC1] in the day to day running of a CU is very different than the role a bank board has.

Looking back over the last decade, the number of CU mergers has held pretty steady at around 250 transactions per year. The least active year was in 2010, at the height of the financial crisis, with only 210 transactions. 2014 was the most recent peak with 274 transactions. 2017 saw the slowest year of M&A activity yet, with just 200 transactions.

The driving forces behind CU M&A are similar to those of banks. The majority of the mergers are the consolidation of smaller institutions that find the need to grow rapidly. This growth is necessary so that the institutions can reach the critical mass needed to survive in a very competitive and regulation heavy industry. Over the last few years we have seen bank M&A activity slow down, and CUs have followed a similar pattern. Since we are seeing an even greater slowdown in M&A activity in the CU space, it indicates that charter conversions appear to be opening up the needed avenues for additional growth that CUs are searching for.

M&A activity in the CU industry is very important, and an often overlooked indicator for the overall health of the financial services industry. When CUs feel the pressure to merge that can signal issues around regulatory burden and market competition. Since CUs are not publicly traded, there is not the earnings pressure from Wall Street that many banks face. However, as mentioned above, CUs continue to move to the community model. This will likely cause more local competition between CUs, which can also provide incentive for M&As.

It appears the outlook for CU M&A is a slowing down, with between 175 – 225 transactions happening in 2018. With interest rates on the rise, the overall financial industry is positioned well for stronger earnings. If the economy continues to improve as well, this could be a banner year for financial institutions’ profitability, which will continue to put less pressure on CUs to merge.

Predictions: M&A in 2017

Merger and Acquisition (M & A) is not something that is typically associated with Credit unions. In the past, credit unions typically focused on a certain business or industry, usually referred to as a “Select Employee Group,” or more commonly known as a SEG. Until 2005, about 82% of Credit Unions were structured this way. Because of this structure, mergers between credit unions were often driven by mergers between businesses. If large companies that both had established credit unions merged, such as an airline, that would prompt a merger of their credit unions.

Over the last decade or so, the structure of credit unions has shifted from the SEG model to a community based model. Community based credit unions are not restricted by SEGs and can open their field of membership to a group in the same geographical area as designated by the NCUA. The current mix of SEG vs Community Credit Unions has shifted so that now almost 36% of Credit Unions are community based. Looking at 2016 NCUA community charter approvals, there were 21 approved conversions from SEG to community charters vs only 4 approved for new SEG based credit unions. This means the ratio of SEG vs community based credit unions will continue to shift towards the community structure.

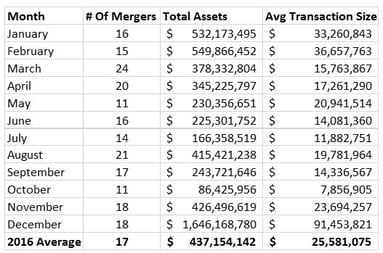

The structure of credit unions is very important when looking at M & A, because the majority of M & A activity happens between small (less than $100mm in assets) community based credit unions. As detailed in the below chart, the average transaction size for merging Credit Unions in 2016 was only around $25mm in assets:

Looking back over the last decade the number of credit union mergers has held pretty steady at around 250 transactions per year. The least active year was in 2010, at the height of the financial crisis, with only 210 transactions. 2014 was the most recent peak with 274 transactions.

The driving forces behind credit union M & A are similar to those of banks. The majority of the mergers are the consolidation of smaller institutions that find the need to grow rapidly. This growth is necessary so that the institutions can reach the critical mass needed to survive in a very competitive and regulation heavy industry. Over the last few years we have seen Bank M&A activity slow down, and credit unions have followed a similar pattern. This has likely been driven by the political and economic uncertainties over the last year. As the U.S. interest rate environment and regulatory environment improves over the next 12 – 18 months this trend may reverse course.

M & A activity in the credit union industry is a very important, and often overlooked bell weather for the overall health of the financial services industry. When credit unions feel the pressure to merge that can signal issues around regulatory burden and market competition. That said, there are some unique issues around credit unions that also should be taken into account. Since they are not publicly traded, there is not the earnings pressure from Wallstreet that many banks face. On the other hand, as mentioned above, credit unions continue to move to the community model. This will likely cause more local competition between credit unions, which can also provide incentive.

The outlook for credit union M & A appears stable with 200 – 250 transactions happening in 2017. This projection could be influenced as more clarity comes out regarding the new administrations plans around financial regulation. With interest rates on the rise, the overall financial industry is positioned well for stronger earnings. If the economy continues to improve as well, this could be a banner year for financial institutions’ profitability which will put less pressure on credit unions to merge.

Matthew Speed

SVP / Market View Solutions

Hometown: Pensacola, Florida

Alma Mater: University of West Florida

The Author, Matt Speed, has nearly 25 years of experience in the banking industry. The first part of his career was spent at community and regional banks. He has worked in leadership roles in most of the various banking lines of business. Matt has spent the last 12 years at Ceto, leading a team of consultants managing engagements to improve profitability at community FIs.